Car depreciation calculator tax

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Edmunds True Cost to Own TCO takes depreciation.

1xkf5uw5ukzeim

Above is the best.

. Web Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. Web Work-related car expenses calculator. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

Web MACRS Depreciation Calculator Help. Web Example Calculation Using the Section 179 Calculator. All you need to do is.

Gas repairs oil insurance registration and of. Web The calculator also estimates the first year and the total vehicle depreciation. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles.

Web Car Depreciation Calculator. Ad Our Resources Can Help You Decide Between Taxable Vs. Theres Never Been a Faster Safer or Fairer Way to Sell Your Used Car Today.

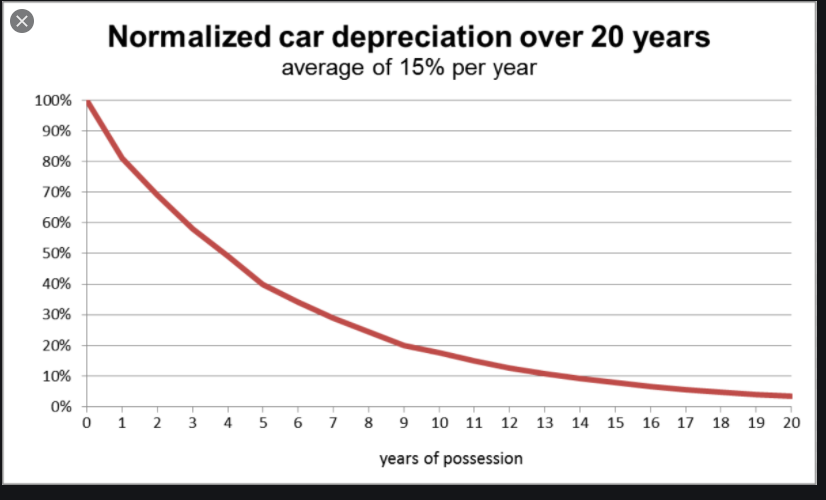

D i C R i. Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Web The depreciation is calculated by applying the vehicles depreciation rate average high or low and then adding the number of years you anticipate owning the vehicle.

Web The MACRS Depreciation Calculator uses the following basic formula. In fact the cost of your new car drops as soon as you drive it off the dealership. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab.

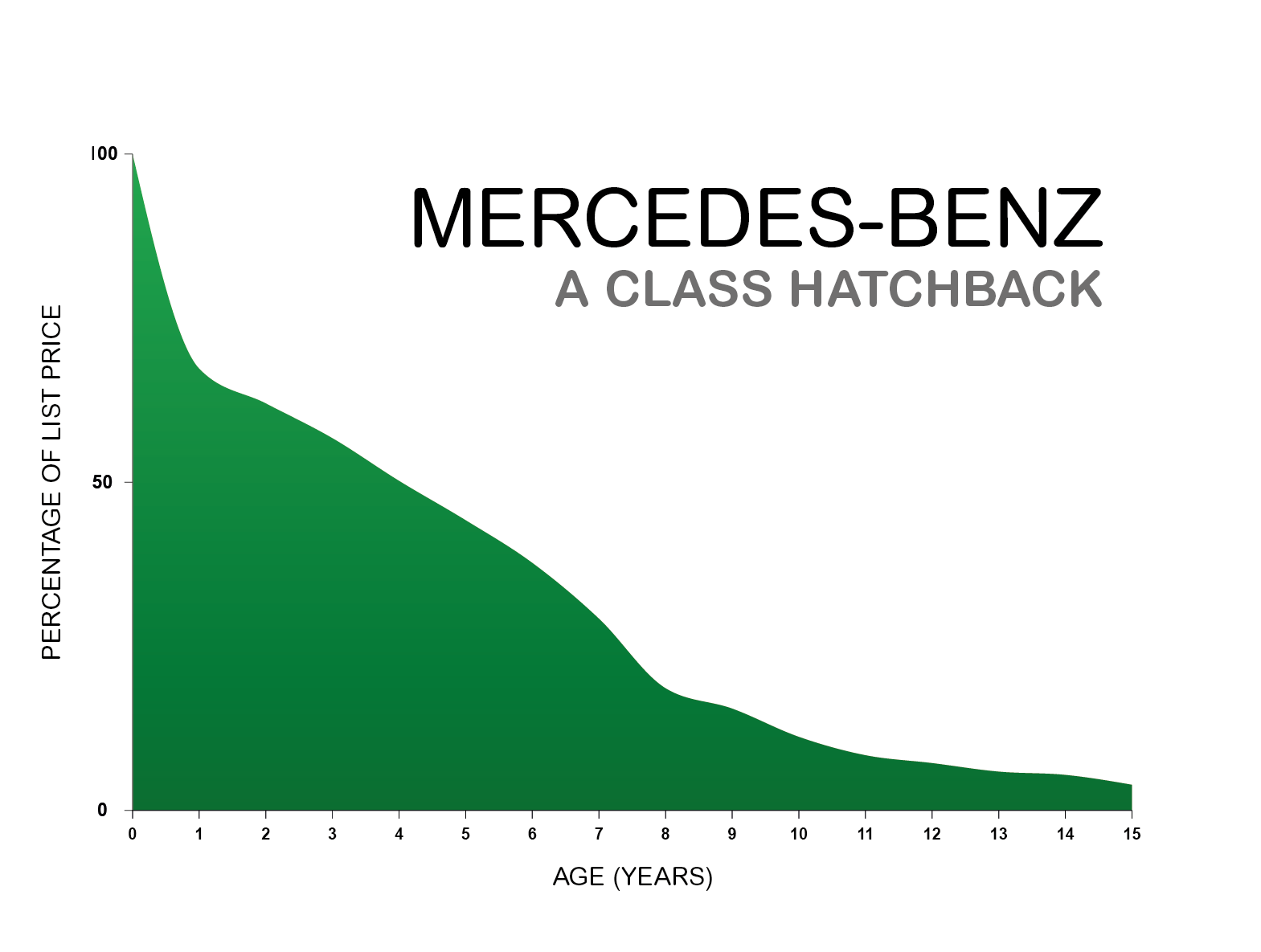

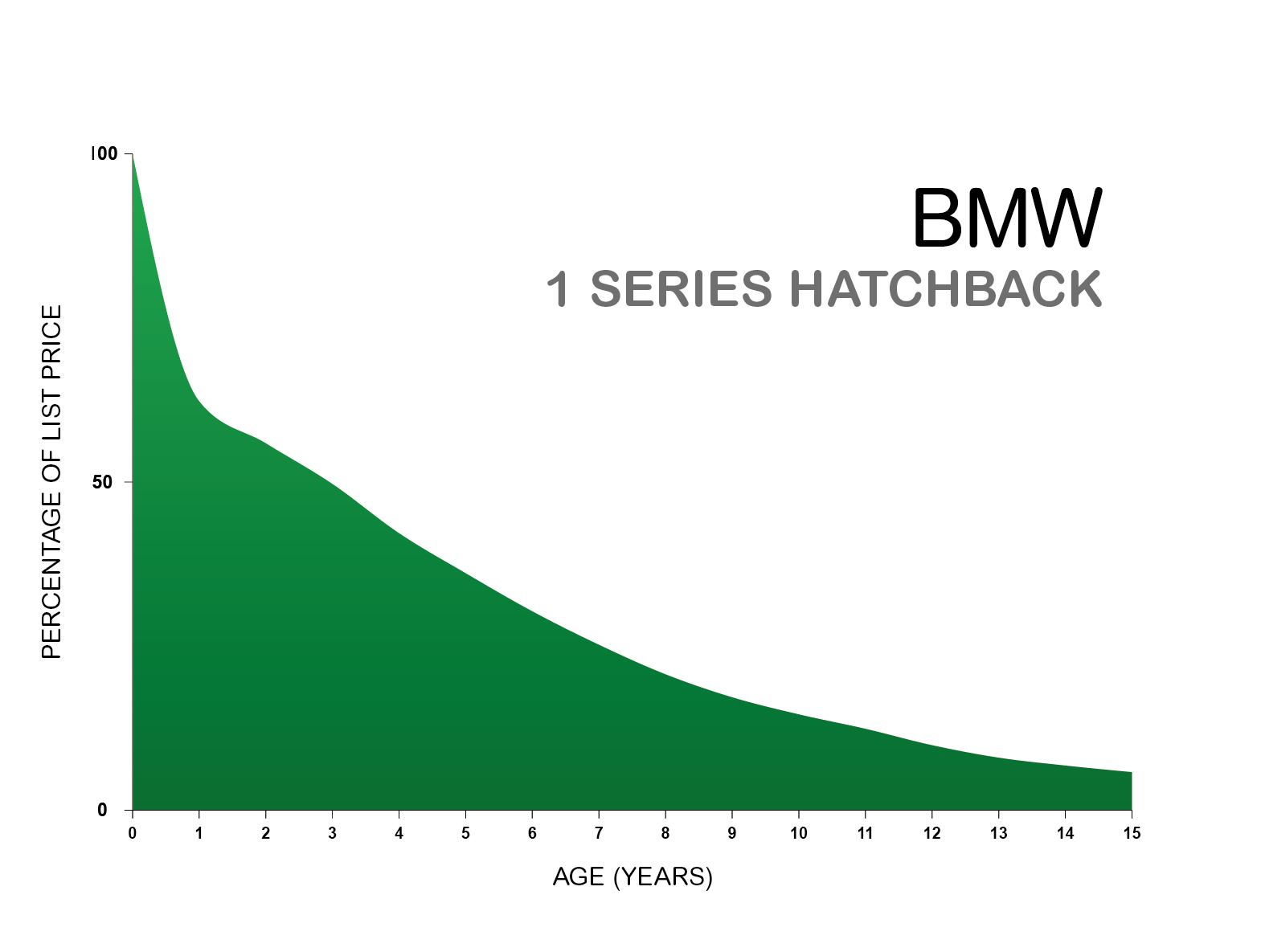

Web Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle. Web Car depreciation refers to the rate at which your car loses its value from the first year you bought it. To calculate your deduction multiply the.

Divide that difference by the new-car value multiplied by 100. The yearly depreciation of a car is the amount its value decreases every year. It can be used for the.

Ad Receive Pricing Updates Shopping Tips More. Depreciation of most cars based on ATO estimates of. Find the difference between the cars value when new and its value today.

C is the original purchase price or basis of an asset. Web Section 179 deduction dollar limits. Web The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet devices.

It is fairly simple to use. Select the currency from the drop-down list optional. Web Rick Mony October 14 2021 3 min read.

Web Calculate the cost of owning a car new or used vehicle over the next 5 years. We will even custom tailor the results based upon. Get A Free Quote Online Today.

Loan interest taxes fees fuel maintenance. This limit is reduced by the amount by which the. Where Di is the depreciation in year i.

Under this method the calculation of depreciation is based on the fixed. A car depreciation calculator is a handy tool that helps estimate a cars value after being used for a given amount of time. Web Before you use this tool.

Web This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can. Web IQ Calculators hopes you found this depreciation schedule calculator useful.

Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime. Ad Rated 49 Stars for Customer Satisfaction by Thousands of Happy Car Selling Customers. Web In 2022 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the.

Web Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. Web Cost of Running the Car x Days you owned 365 x 100 Effective life in years Lost Value. Web Heres the easy formula.

We base our estimate on the first 3.

Depreciation Formula Calculate Depreciation Expense

Depreciation Of Vehicles Atotaxrates Info

Free Macrs Depreciation Calculator For Excel

Car Depreciation Explained With Charts Webuyanycar

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

How Much Is Car Depreciation Per Year Quora

Depreciation Rate Formula Examples How To Calculate

Car Depreciation What Is It And How To Minimise It

Car Depreciation Rate And Idv Calculator Mintwise

Depreciation Calculator Definition Formula

Car Depreciation Explained With Charts Webuyanycar

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculator Depreciation Of An Asset Car Property

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Car Depreciation Calculator

Depreciation Of Vehicles Atotaxrates Info